Company loses $3.4 million compared to net profit of $8.5 million same quarter last year.

Amway Corp.'s latest report on the financial status of Amway Asia Pacific paints a grim picture indeed—net sales are down 30%, and net profits plunged almost 150%. "The Company recorded sales declines in all markets", stated Steve Van Andel. chairman of Amway Asia Pacific. Distributor renewals also declined in all AAP countries except Australia and New Zealand, which saw "slight increases."

Amway's press release places all the blame for the declining revenues and recruitment on the Asian economic crisis, but as already reported here, less biased observers have pointed also to Amway's horrid reputation.

Posted 1/9/99

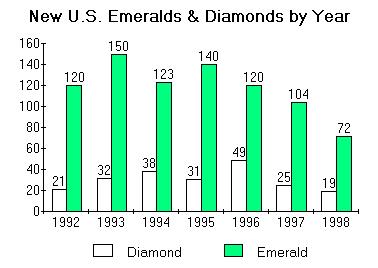

Dick DeVos' characterization in a 1994 U.S. World News & World Report article of U.S. growth as "slowing" may have been an understatement. If the number of new Diamond and Emerald level distributors is any indication, Amway's U.S. distributor force may actually be shrinking. Charles Midgett, whose web site "The Other Side of the Plan" contains a wealth of revealing data, has been tracking the number of new Diamond and Emerald distributors announced in the U.S. Amagrams. The number of new pins for 1998 was the lowest in the past seven years, with new Diamonds down to 19 from a 1996 peak of 49, and new Emeralds down to 72 from a 1993 peak of 150. Obviously it's not only in Asia that Amway is in trouble, and one has to wonder if Amway's new "I-mall" venture is a desperate attempt to save a sinking ship (or a collapsing pyramid).

Posted 1/9/99

Amway in distinguished company…Scientology, Unification Church, Heavens Gate also on list.

"Mind control is psychological coercion. Mind control techniques stifle individuals' ability to think independently and rationally. For individuals under the influence of mind control, freedom of religion, free speech, and other freedoms of expression which derive from free thought, are literally impossible. Without freedom of thought, all our freedoms become enfeebled or meaningless."

—FACTnet mission statement

Based in Boulder, CO, FACTnet's board of directors includes world-renowned cult expert and counselor Margaret Singer, author of "Cults in our Midst"; entertainer Steve Allen; and Patricia Ryan, whose father Congressman Leo J. Ryan was murdered in 1978 by the followers of Jim Jones. (Phil Kerns, author of "Fake It 'Til You Make It: Inside Amway", also lost family at Jonestown, and in his book comments on the similarity between Amway and the People's Temple.)

FACTnet's October-December newsletter featured the following article on Amway:

"Amway. Financial independence, personal power, and a life of luxury—all alluring parts of the touted American dream, craved by many but attained by few. It's the kind of life that Amway Corporation promises its distributors. However, as those who have been involved in the company all too often discover, that promise doesn't come with a money-back guarantee. 'They love people who are broke because they're weak,' says Lori Mauldin, according to FW Wire [July 13, 1998]. Mauldin had a brief but memorable experience with Amway. 'They really prey on the desire of materialism. They constantly show the material gain and say, 'You can have this too.' When you're recruiting people, they tell you to ask people what their dreams are. They love to find the people who want the Mercedes, the boats, the big houses. That's exactly what they're looking for." Despite its success, Amway's track record is one with a high dropout rate, low average incomes, and lawsuits from competitors, regulators, and its own distributors. Amway is often referred to as a cult and considered a pyramid scheme (despite a 1979 Federal Trade Commission ruling to the contrary. "Amway is a cult. There's no getting away from that," Brock Akers, a Houston attorney representing 29 distributors in a $200 million suit against the company, told FW Wire. "My clients, who are very high up in the Amway system, just now are realizing some of things. They're getting deprogrammed. And they can't believe some of the things they have done. I think the Internet may ultimately cause the demise of Amway. Anyone who is thinking about getting into Amway, who has a computer and has a clue can check it out. And they're going to find a lot of unhappy people out there." Amway detractors are many and yet it remains a fascinating mystery of the business realm. Indeed, the superhighway is strewn with tales of money, dreams and friendships lost in the treacherous waters surrounding Amway. Most are in the process of rebuilding their lives; some are attempting to mend broken marriages. All are bitter and more than a little angry with themselves for being duped."FACTnet's web site is an excellent resource for those researching cultism and mind control.

Posted 12/26/98

The latest lawsuit filed by the plaintiffs in the Morrison case alleges that Ted Fish and Andy Andrews, two popular Amway motivational speakers, bowed to pressure from Dexter Yager and reneged on their agreements to appear at rallies sponsored by Team Resources.

In their original lawsuit, the Morrison plaintiffs claim they were improperly cut off from the support of the Yager/Wilson organization and, as a result, were forced to create their own support system on short notice. Here the plaintiffs claim that Team Resources, the support system they created, contracted with motivational speakers Fish and Andrews, but that both speakers refused to fulfill those contracts for fear of "alienating" Yager. Yager, of course, is Amway's single most powerful distributor, and his considerable influence is well known.

Posted 12/24/98

Seven counts remain.

According to an Amway press release, the judge in the Texas Procter & Gamble case dismissed six of the claims brought against Amway by P&G. Dismissed were of unfair competition; negligence and negligent supervision; and three alleged violations of the Racketeer Influenced and Corrupt Organizations (RICO) Act. The remaining counts include business disparagement; defamation; injury to business reputation or trade name or mark; section 43(a) of the Lanham act; tortious interference with prospective business relations; vicarious liability; and fraud. I'm working on obtaining a copy of the judge's decision and will post it here at the earliest opportunity.

Posted 12/24/98

Amway prohibits its distributors from using the web to advertise product or solicit recruits for "their" businesses. Is it because Amway saw yet another opportunity to milk them for cash?

For the past couple of months the grapevine has been buzzing with the news that Amway will be branching off into the "I-Mall" business. A recent announcement posted on the INA web site would seem to confirm this:

"On September 1, 1999, a monumental Internet venture will be launched. Several of the largest Fortune 500 companies are joining forces to form a new entity, which will be one of most comprehensive virtual malls and business opportunities in the world. These companies have seen fit to utilize the massive global distribution system that covers 82 percent of the world's population right now. The compensation plan and the independent business owner force that ABN, Amway Business Network, and the Amway Corporation have used to develop a seven billion dollar per year marketing giant will be effectively utilized to facilitate this international alliance. These premiere companies will join in this massive virtual venture to bring a shopping mall to your front door. Leadership 1999 will provide an exclusive educational opportunity for Independent Business Owners to plan and prepare for this momentous event. Launch your future into unprecedented success and financial greatness by attending Leadership 1999."Few details are known at this point. I've put together a page for some of the comments I've gotten from distributors.

It should be emphasized that at this point that none of this has yet been confirmed—with the exception of the announcement on the INA web site—and some or all of it may turn out to be untrue. And while the INA announcement is big on the usual Amway hype and puffery, it says nothing about how the average distributor will participate in and benefit from this venture.

At present, Amway's rules regarding the use of web sites by distributors highly restrictive. This is just one more example of how Amway, while constantly trying to represent to the courts and to the public that its distributors are "independent", exerts a degree of control over them that can only be described as oppressive. You would think that a truly independent business owner would have a high degree of control over their own business, including the freedom to determine how and where products could be sold, to whom products could be sold, what marketing methods to invest in, etc. And you would be right. The problem, of course, is that Amway distributors are anything but "independent" and have little or no control over significant aspects of their businesses. Any real business owner is free to take advantage of the new opportunities offered by web-based marketing, opportunities that by all accounts are becoming increasingly important. Amway distributors, on the other hand, are restricted to using web sites only to provide additional information to persons who have already been contacted on a "face-to-face" basis.

All this raises a very significant question: how will the average distributor's participation in Amway's proposed I-Mall differ from what they are currently allowed (or not allowed) to do on the web? One possible answer is that distributors will be allowed to take better advantage of the web's potential, but only if they pay Amway for the privilege. If this is the case, then it would appear that Amway has devised a blatant scheme to charge its distributors for something that they could easily and cheaply (almost every service provider offers free space for a web site) obtain without Amway's assistance. And of course if distributors who participate in the I-Mall are not allowed to take better advantage of the web, then why would they want to bother? There's also the question of what "taking better advantage of the web's potential" will mean, if indeed that turns out to be the case. What will a customer be confronted with upon entering the Amway I-Mall? Hundreds or thousands of distributor sites, each one offering the exact same products? What would be the point, and why would any distributor want to bother?

Yet another important question is whether or not anyone besides Amway distributors are going to be interested in buying Amway products, which are for the most part notoriously uncompetitive and consumed almost exclusively by distributors themselves, who are exhorted to do so as a means to achieve their "dreams."

We'll just have to wait and see what Amway has in mind.

UPDATE 12/7/98: Looks like the I-mall, even though it's at least nine months away from becoming a reality (barring unforeseen delays or a possible scrapping of the entire plan), is already being used as bait to hook the hapless victim. Here's a recruiting pitch someone received via email and forwarded to me. The mark had previously asked this distributor the dreaded "is this Amway?" question…notice the response. At this point we have no way of knowing if the I-mall will indeed be a "totally new entity," or if this and the other claims are just more of the usual exaggeration and misrepresentation.

"Glad you are interested. No, this business is not Amway. Nor is it either of the other two you listed. Anyways, this new corporation is named… E-Biz Virtual Mall According to current business publications reporting on Electronic Commerece, the Internet will be doing over 1 trillion dollars by the year 2002. Internet based E-Com is currently approaching 100 Billion Dollars, and growing at a rapid rate. We've contracted with a successful Multi-Billion dollar corporaton that is putting together the largest most comprehensive on-line interactive Virtual Shopping Mall. People currently have opportunity to take advantage of creating continious profits from this mall by using it themselves and refering others to it. The Principal owners have currently contracted with over two hundred "Fortune 500" companies, as well as thousands of other smaller manufactures. We are presently conducting a name search fot the Virtual Mall. During this pre-Launch time we are calling it E-Biz Virtual Mall. Our official launch date is 9-1-99. Now, we have contracted with the Amway corporation to use their compenstion package because it is patented, copyrighted, and has passed all Federal Trade Commission reviews. Although we will be making changes in the verbage. Also they are the only corporation that has the infastructure in place to handle such large orders with a 98% delivery rate. Don't misunderstand me, this is not a re-packaging of the old Amway. E-Biz is a totally new entity with new partners, new ownership, and new managment. The Amway Corporation will continue to do business in their traditional manner, manufacture fine products and have lines of sponsership to create Amway Distributors. We will have nothing to do with that. Amway will only have one store amoung our current total of 1200 in our Virtual Mall. We are very exciting. Internet E-Com is the way of the future and we are ready to embrace and profit from this paradigm shift. If you are interested let me know. If your not, maybe you need to read it again. Happy Holidays! Keep in touch."

Posted 12/3/98

Attorney charges that Amway cooked up arbitration "agreement" when it realized that a potentially embarrassing and damaging lawsuit was probable.

"…When Amway announced the rule that everyone had to arbitrate their disputes, they did not even know how the process would work. It was a hurried attempt to prevent what they saw coming--a big lawsuit."

Following a judge's ruling that they must go through Amway's mandatory arbitration process, the plaintiffs in three Texas lawsuits have decided to not sit back and allow Amway to unilaterally deprive them of their constitutional rights. In the appeal, filed on 10/23/98, plaintiff's attorney Brock Akers raises a number of reasons why Amway's arbitration "agreement" is invalid, including:

Akers also points to the inherent unfairness of the arbitration process as designed by Amway:

"Further, Amway controls everything about the whole process. Amway picks the arbitrators. Amway trains the arbitrators. Amway has the power to remove the arbitrator. Such a system implemented, designed and controlled by one party can not be fair to an adversary of that party … [the defendants] did not know, for instance, the arbitrators would be hand selected and trained by the Amway Distributors Association. They did not know that this same group, on whose board sits many of the Defendants herein, would have the right and power to remove the arbitrators from the process."

That raises an excellent point, one all potential (and current) distributors should pay close attention to. While it's obvious that Amway is forcing you to give up your constitutional rights, it is much less obvious what these rights are being replaced with. How much do you know about the workings of Amway's mandatory arbitration process? How, and by whom, is the arbitrator chosen? Who are the potential arbitrators? Can the arbitrator even be an Amway distributor who has been the subject of complaints similar to yours? What "rights" do you have if you don't think the arbitrator is fair and unbiased? How much will the arbitration process cost you? (Yes, it will cost you.) What is Amway doing to insure that distributors are fully informed of the facts before signing away their rights?

Attorney Akers also raises another significant point: why does Amway, who consistently claims that distributors like Yager and Britt are "independent" from Amway, force distributors to not only arbitrate disputes with Amway Corp., but also arbitrate tools-related disputes that involve their uplines but not Amway Corp.?

"When Joe Morrison sues Dexter Yeager and Internet, Yeager's company, where and how have these parties agreed to an arbitration agreement between them? If this lawsuit involved, for instance, some land deal gone sour between them, would the Amway arbitration provision apply? Of course not. Amway takes extraordinary pains to distance itself from the business supply materials game. They should not be permitted to invoke this arbitration provision and still disclaim responsibility for the conduct of the co-Defendants such as Yeager."

Good question. It would seem that Amway, in addition to providing a seemingly legitimate "front" for Yager and his ilk to operate behind, is also eager to protect them from the legal consequences of what Amway has already admitted is an illegal and unethical business.

Posted 11/22/98

P&G reponds that suit is "a desperation move by Amway as we advance both of our cases against it in Houston and Salt Lake City … Amway has attempted to pursue this ridiculous claim in the Utah action, and the Federal court there dismissed it…This suit is really without any substance and we are going to move immediately to have it dismissed."

In an apparent attempt to resurrect the charges in its countersuit thrown out by the Utah court, Amway Corp. has filed a lawsuit against P&G in Michigan. Featured prominently in the suit is this web site, which Amway accuses P&G of paying for and using to spread "false statements, half-truths and distortions."

Amway's hysterical accusations are nothing new. In September of 1997 I spent an entire day being deposed by Amway's attorneys. They were told that:

I'll be responding in more detail to Amway's latest pack of lies. In the meantime, here is a letter I wrote to Scott Leith at the Grand Rapids Press in response to an article he wrote about this lawsuit. You can also read Sleazeway's previous attacks on me and my detailed responses.

Posted 11/11/98

Having been unable and/or unwilling to put an end to unethical and illegal practices, Amway instead attempts to hide its problems by depriving distributors of the right to pursue justice through court system or to even publicly discuss disputes.

UPDATE: The text of the judge's decision is now available on AUS.

On October 15, a judge for U.S. District Court in the Southern District of Texas ruled that the plaintiffs in the Morrison, Musgrove and Pruitt lawsuits must pursue their complaints through the arbitration process that Amway now forces on all its distributors. (I believe that the Griffith lawsuit was also similarly stayed, but I haven't yet confirmed this.)

Amway long ago acknowledged that the tools business is illegal and unethical, that distributors are being seriously abused, and also that Amway has been unsuccessful in controlling these problems. Until recently, Amway could count on the relative secrecy of the many lawsuits and distributor complaints it has had to deal with. With the advent of the internet and web sites like this one, however, that situation has changed dramatically; Amway's dirty laundry is now aired in public, and each new lawsuit brings additional embarrassment and makes it more difficult for Amway to deny the facts.

As part of the settlement of the Hanrahan class action lawsuit, Amway enacted additional rules that were supposedly aimed at curbing the tools abuses. Rules, of course, are useless unless enforced. Amway has had rules in place since long before the Hanrahan lawsuit, and it could not be more clear that these rules are unenforced and/or ineffective. Amway's own corporate counsel have, in fact, admitted in an interview with a Baton Rogue Advocate reporter that Amway does not even enforce the critical "retail selling" rule that supposedly makes Amway a legitimate business rather than another illegal pyramid scheme, and went on to state that the FTC "does not require Amway to monitor compliance with this [the retail selling rule] or any other rule." We can only assume that "any other rule" would include rules regarding the representation and sale of Business Support Materials.

Amway has, however, taken at least one tough and uncompromising step towards solving its problems. Unfortunately for its distributors, that step was not to finally protect them from being swindled and abused, but to prevent further damaging public embarrassment to Amway Corp. and the AMO "Tools Kings." Starting in 1998, Amway instituted mandatory arbitration agreements for anyone starting or renewing a distributorship, and for any distributor who purchases BSM (Business Support Materials). Simply put, anyone who now wants to be an Amway distributor must give up his or her right to file a lawsuit against Amway Corp. or his or her upline, and to instead agree to settle any disputes through a binding arbitration process. It's important to understand that Amway is not offering its distributors a choice of how to resolve disputes…it is taking that choice away from them. As if that weren't bad enough, distributors are also prevented from discussing the particulars of complaints that go to arbitration, or even from divulging the outcome of that process.

Amway has, however, taken at least one tough and uncompromising step towards solving its problems. Unfortunately for its distributors, that step was not to finally protect them from being swindled and abused, but to prevent further damaging public embarrassment to Amway Corp. and the AMO "Tools Kings." Starting in 1998, Amway instituted mandatory arbitration agreements for anyone starting or renewing a distributorship, and for any distributor who purchases BSM (Business Support Materials). Simply put, anyone who now wants to be an Amway distributor must give up his or her right to file a lawsuit against Amway Corp. or his or her upline, and to instead agree to settle any disputes through a binding arbitration process. It's important to understand that Amway is not offering its distributors a choice of how to resolve disputes…it is taking that choice away from them. As if that weren't bad enough, distributors are also prevented from discussing the particulars of complaints that go to arbitration, or even from divulging the outcome of that process.

If you think I'm being overly dramatic when I say that this agreement violates the constitutional rights of Amway distributors, consider that the ACLU has already filed suit against two companies in California that force similar "agreements" on their employees…if they want to keep their jobs, they have to give up their right to sue their employers.

"Most of us need to work, " said David Schwartz [no relation], Senior Staff Counsel of the ACLU of Southern California. "Employers are taking unfair advantage of that fact by bullying employees into giving up rights in exchange for getting or keeping their jobs.

"When an employee finds he or she has a claim, suddenly it hits them that they can't take their employer to court," Schwartz said. "It's grossly unfair for companies to force employees to check their constitutional rights at the office door."Amway distributors may not be "employees" of Amway, but what really is the difference between firing an employee who relies on his or her income, and "firing" a distributor who has invested time and money in his or her distributorship and relies on income from that distributorship? What if that distributor is one of the few who manages to make a full-time income from an Amway distributorship? It certainly seems to me that Amway is likewise bullying distributors into giving up their rights in exchange for keeping their distributorships.

So who is really being protected by this agreement? Amway claims that it instituted these agreements for the benefit of its distributors, out of the kindness of its corporate heart. An announcement in the 8/8/97 Newsgram offers this explanation:

"This change incorporates an agreement to arbitrate all distributor disputes relating to the Amway business, including issues involving the Sales and Marketing Plan and Rules of Conduct. Arbitration is a process of dispute resolution by which an independent third party, known as an arbitrator, listens to both sides of a dispute and then renders a final and binding decision. Arbitration can be a very effective way to quickly resolve any disputes which cannot be resolved by Amway's Conciliation process. In addition, arbitration is usually much faster and less costly than a lawsuit."

And in an announcement posted on the Amway Business Network in October of 1998, Amway further states:

"On Oct. 15, the court agreed with Amway, closed the cases and sent the parties to arbitration to resolve their disputes as required by their distributorship agreements. Amway believes this is a victory for all Amway distributors. It confirms that the conciliation and arbitration procedures spelled out in the Amway Rules of Conduct are the best and the only way for distributors to work out any disagreements quickly, fairly and inexpensively.

"It is also an excellent example of how Amway and the ADA Board, which represents all Amway distributors, continue to work together to make this the best opportunity anywhere."

As previously noted, Amway is not offering arbitration as a choice. Amway apparently has little faith in its professed belief that arbitration is "the best and the only way for distributors to work out any disagreements quickly, fairly and inexpensively." If it truly were, most distributors would gladly take that option over filing a lawsuit. So why doesn't Amway offer distributors a choice instead of forcing them into arbitration? And even if arbitration were the better approach, why does Amway further gag distributors to prevent them from discussing their disputes or the resolution of those disputes?

There is no argument (on my part, anyway) that arbitration may sometimes be the less expensive and troublesome way to go. But what if a distributor, after considering the various factors involved, decides that it is not? What if a distributor decides that he or she is willing and able to spend the time and money on a lawsuit? Shouldn't that distributor be able to make that choice? Amway says no, and the reason could not be more obvious: lawsuits are a matter of public record, but arbitration proceedings are not. Even when a lawsuit is filed, Amway employs various means to keep as much information as possible from the public, typically by making gag orders a part of any settlement agreements. Amway cannot, however, hide all the evidence of a lawsuit, as some of the documents will always be a matter of public record. If Amway can force distributors into arbitration, however, it gags them much more effectively than it could in a lawsuit. This is what Amway insultingly tries to fob off as "a victory for all Amway distributors." Well, it's at least a victory for those distributors at the top of the pyramid who run and profit from the tools business, isn't it?

Distributors who are signing up for the first time can decide for themselves if they want to voluntarily give up their rights in order to pursue the Amway business. But what about distributors who have already put a great deal of time and money into building a business that they do not want to give up? A business that Amway promised them was "their business"? Their only choice, it would seem, is to give up their rights or give up their business, even though they had never agreed to do any such thing when they originally signed up. What kind of "choice" is that? It's important to also note that the ADA board, which supposedly represents the average distributor, is made up of the very high-level distributors who reap enormous profits from selling tools to those distributors, who are the targets of frequent distributor lawsuits, and who stand the most to gain from keeping the tools business running as usual.

It should also be noted that Amway's ABN announcement contains a glaring lie. The court's decision regarding the Texas lawsuits did not "confirm that the conciliation and arbitration procedures spelled out in the Amway Rules of Conduct are the best and the only way for distributors to work out any disagreements quickly, fairly and inexpensively." The issue before the court was not whether or not the distributors would be best served by Amway's arbitration agreement, but simply whether or not they had agreed to abide by it; obviously it was the court's decision that they had.

Posted 11/2/98

"Amway Corp. today announced global estimated retail sales of $5.7 billion for the fiscal year ended Aug. 31, 1998, a decline of more than 18 percent from estimated retail sales of $7 billion the previous year."

--Amway Business Network

The other shoe has dropped. After a recent Amvox from Dave Van Andel warned of coming "belt tightening" measures, Amway on Oct. 26 announced on the Amway Business Network that its annual worldwide sales had plunged 19% from $7 billion to $5.7 billion. (Since Amway uses "estimated retail sales" figures, and only a small percentage of Amway product is actually sold at retail, Amway's actual earnings are less than reported.)

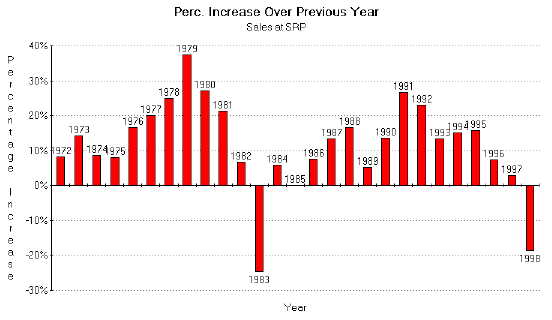

Not since 1983 has Amway seen sales drop off so dramatically compared to the previous year (see chart). Forbes magazine attributed that decline in sales to negative publicity ("The Power of Positive Inspiration", 12/9/91). Rich DeVos, however, has stated in court that Amway lost "upward of $300 million in volume" during an "adjustment period" following Amway Corp's attempts in the early '80's to put the brakes on the illegal and unethical abuses of the "tools" business (Rick Setzer v. Amway Corporation, 1986. DeVos also admitted that these efforts were not successful). The $300 million cited by DeVos would account for almost the entire drop in volume in 1983…a strong incentive for Amway to cease its efforts to enact any real reform.

In his Amvox message, Van Andel characterized Amway's growth in China and Korea as being at a "virtual standstill". With regard to Korea, at least, this was a gross understatement. According to a recent article in the Korea times, Amway's distributor force in Korea has gone "from 1 million to a mere 140,000" due to negative publicity. To characterize this as "virtual standstill" is like trying to pass off a decapitation as a "small cut."

Posted 10/30/98

Judge says satanism rumor targeted company, not individual products.

On 9/4/98, the judge in the Utah P&G/Amway case dismissed another of P&G's claims, this one relating to the Lanham Act, which apparently has to do with unfairly disparaging a competitor's products. P&G had claimed that the "satanism rumor" which has persistently been spread by Amway distributors had disparaged P&G's products as well as the company itself. The judge disagreed. The remaining counts in the lawsuit are defamation, negligent supervision, and vicarious liability. In the meantime, Amway's entire Utah countersuit was dismissed, and the P&G's Texas lawsuit against Amway may go to trial as early as this spring.

Posted 10/15/98

Asian economic crisis contributes to woes, but Amway's poor reputation is also a factor.

In a recent "Diamond Hotline" Amvox message, Amway corporate board member Dave Van Andel tried to put the best face possible on the bad news: due to declining revenues, Amway corporate is planning a round of layoffs and "early retirements."

Amway's growth rate (sales at suggested retail compared to previous year) peaked at most recently at 27% in 1991 and has fallen steadily since then. 1997's growth rate was a negligible 3%, barely enough to keep up with inflation here in the U.S.. (See Scott Larsen's excellent "Little White Lies" web site for a chart of Amway's growth rate since 1971, along with lots of other charts and data.) Amway has not yet released its sales figures for 1998, but Van Andel's warning makes it seem likely that Amway's growth rate will fall into the negative for the first time since sales dropped dramatically by 25% in 1983.

Van Andel says that "The primary driver of this corporate belt tightening is the Asian economic situation and the strong U.S. dollar." This is no doubt partly true, but expert sources that have no need to pump out "feel good" propaganda aimed at Amway distributors see other factors in play. The Wall St. Journal, in its 6/16/98 article Analysts See Bumpy Road For Shares of Amway Japan, acknowledges the impact of Japan's economic crisis on Amway's plummeting stock price. However, the Journal goes on to state "But most crippling to Amway here, analysts say, is the flurry of bashing it has had to take in recent months from Japanese government agencies and the country's news media." An analyst at Merrill Lynch Japan Inc. even goes so far as to make reference to "…a threat of Amway's sales collapsing in the face of growing negative publicity…".

Japan is an important market for Amway, perhaps it's most important. Forbes reported in a November 1996 article that "Amway Japan now accounts for more than a third of Amway's revenues", and a 1994 U.S. World News & World Report article points out that "Amway's concentration abroad is part of a strategy to offset slowing U.S. growth", and quotes Dick DeVos as predicting that Amway's U.S. operations would account for only 25% of Amway's revenues by 1996.

Van Andel also characterizes Amway's growth in China and Korea as being at a "virtual standstill". The government of China recently banned multi-level type sales, and in Korea Amway was fined for making exaggerated claims about the effectiveness of some of its products. Critics in all three of these Asian countries have accused Amway, and MLM in general, of being an unsavory and unwelcome influence on their society.

Amway's revenues also may be falling in Mexico, which this article identifies as "Amway's second most important market in Latin America after Brazil."

With growth in the U.S. having peaked and stagnated, and now sales in key markets like Japan, China and Mexico also dropping, it's no wonder that Amway is having financial difficulties. It's too bad that Amway can't afford to cut overhead by down sizing the army of attorneys it counts on to defend it from all those distributor lawsuits (see items below)…perhaps then it could afford to hold onto the honest workers who will be losing their jobs.

Posted 10/4/98

Suits allege theft of moneys by Diamond Bill Bergfeld—and the subsequent cover-up by Amway and Diamonds—as reason behind spate of Texas lawsuits.

"The Musgroves were, prior to the tortious acts described in the petition, successful distributors in an organization controlled by Dexter Yager. The primary income generated by this organization came from the sales and marketing of motivational tapes, videos and business functions ("tools"). The Yager distribution network is a distribution organization that has associated itself with Amway Corporation for the purposes of recruiting distributors. In return, the Yager entity allows Amway to use its distribution network to sell Amway products."

"Access to Yager functions as an organizer and/or speaker is one of the more significant ways money is made in the Yager system. The function market is, in fact, one of the essential ways a distributor who has achieved Emerald or above earns income within the system. The organizational jargon for successfully doing this is being "plugged into" Dexter. If you speak at a function controlled by Dexter or a Yager general like Don Wilson, as a speaker you get a piece of the action for that function. That piece is often paid in cash. Participation in such functions is a critical step to succeeding in the Yager organization since "… the one major thing sold by Yager's business are major functions." (Emerald strategy meeting)."

"Yager's ability to control and police distributors within his organization is well known to Amway and his distributors. Yager "generals" and certain selected Diamonds within the Yager organization control entry into the tools and functions market. Entry into those markets is difficult. Once entry into the markets is achieved, access and income participation is tightly controlled by the top of the organization's leadership. Diamond level distributors who are "plugged" into Yager are allowed to allocate markets both vertically and horizontally. Access to financial information regarding income distribution in the tools and functions markets is very tightly controlled and is known on a need to know basis only."

"The Yager leadership does not publish information about income distribution from the "tools" and "functions" markets in order to maintain an information edge and to prevent the lower levels from finding out how much money is made in those markets."

"Any departure from this distribution setup is strongly discouraged on both a financial level and from a psychological level. Any lower level distributor issues or ideas about how much money is generated by the upline, how money is distributed, and whether books, videos, and tapes should be obtained at a discount are not tolerated."

"By September, it had become apparent that the Bergfelds had stolen thousands perhaps hundreds of thousands of dollars from their downline. It also became increasingly apparent that the upline directly responsible for money channeled through the Bergfelds was not only unwilling to do anything but was in fact, willing to sponsor, edify and bless Bill Bergfeld as a valuable part of the Yager organization."

"Walker, as a possible competent upline counselor to his downline was further compromised by the fact that he had purchased his diamond rather than earning it."

"In truth, Amway is arbitrary and capricious in supporting its distributors. The Amway corporation has in fact, committed itself to supporting the Yager organization and its hierarchy to the detriment of distributors that are induced to enter the Yager organization. This subjective bias on the part of Amway favoring the Yager distributorship is motivated by money, greed and avarice. The Yager organization makes Amway a lot of money. As such, Amway is willing to disregard integrity, truth, objectivity, honesty and all other ethical concepts embodied in the Amway code of ethics to protect Yager's organization."

As you read through this one, you may start feeling that you've stumbled on the screenplay for the latest "Godfather" sequel, rather than just another Amway lawsuit. It seems that with each new lawsuit filed, we are presented with more detailed and convincing evidence indicating that Amway and the AMO's have created and maintained a vast criminal enterprise, the members of which are as eager to victimize each other as they are outsiders. Maybe it's because the plaintiffs in these latest lawsuits (Hayden, Morrison, and now Musgrove) have achieved Direct, Emerald, or even Diamond status, and therefore have an insider's perspective that was lacking in earlier lawsuits. Or perhaps there have been other such lawsuits in the past that we're unaware of. Whatever the reason, it is becoming increasingly difficult to avoid the conclusion that Amway has not only failed to address the illegalities that Amway itself admitted were inherent in the tools system, but has taken an active part in helping the likes of Dexter Yager to fleece the unwary victims who get involved with this business.

These two latest lawsuits were filed by Jeffrey and Cecelia Musgrove and Mark and Deanna Pruitt. Since both complaints are nearly identical, I'm posting only the Musgrove complaint at this time, though I will also post the Pruitt complaint when time allows.

Posted 9/22/98

P&G sanctioned $10,000 by court; other rulings handed down.

In August of 1996 Amway filed a counterclaim against Procter & Gamble in the Utah P&G case, charging P&G with false representation, false advertising, and abuse of process. In short, Amway was accusing P&G of filing its lawsuit against Amway solely for the purpose of harming Amway through negative publicity. In April of 1998, the judge ruled that Amway had no basis for its counterclaim, as P&G's press releases concerning the filing of the suit did not constitute advertising. A number of other rulings were made at the same time, including:

Posted 9/7/98

Amway hit with four more distributor lawsuits; AUS expecting information on yet two more.

Hard on the heels of the Morrison lawsuit, in which a group of high-level Texas distributors accuses Amway of conducting an "evil scheme," three more lawsuits have been filed in Texas and one in Washington state. The three Texas suits include the Griffith lawsuit and two "interventions" filed on behalf of distributors wishing to join the Griffith suit as plaintiffs. All the new Texas lawsuits involve distributors in the same line of sponsorship as the Morrison suit; in fact, the plaintiffs in the Morrison suit are named as defendants in the Griffith suit.

It should be noted that in the Griffith lawsuit interventions, as in the Morrison and Hayden lawsuits, it cannot be argued that the plaintiffs are "losers" who were "too lazy" or "gutless" to succeed in Amway, and are suing because they want to "blame someone else for their own failure." (These are all terms I've seen used time and time again by the Amway Faithful to try and explain away the spate of lawsuits filed against Amway and the AMOs.) All the defendants in the Griffith lawsuit interventions had reached at least the Direct Distributor level, an achievement recognized by Amway and the AMOs as significant—and something 99% of all distributors (including most of those who would dismiss the plaintiffs as "losers") have failed to achieve. These plaintiffs DID succeed, in some cases even to the Emerald and Diamond levels. This also means that they had an inside knowledge of the tools business that the vast majority of fired-up, plugged-in Amway defenders sorely lack.

I am hoping to get pin level information on the Griffith plaintiffs. I am also expecting to shortly get information on yet two more lawsuits filed in Texas, at least one of them by another Emerald level distributor.

The Taylor suit filed in Washington state alleges not only the usual deceptions concerning the tools business, but also an improper upline/downline sexual relationship. Shades of Bill!

Visit the AUS Lawsuits Page for a complete listing of those lawsuits that we've become aware of.

Posted 9/5/98

The Brig Hart lawsuit appears to have been settled. According to the case docket, all the defendants have been dismissed from the case, either by the Harts or by the court. The Hart suit was significant for the fact that Hart, a Diamond level distributor, openly admitted that he makes far more money from his tools business than from his Amway business.

Posted 9/5/98